Blog Layout

Latest News

Battle Of The Brands

June 5, 2019

BATTLE OF THE BRANDS FROM GROCERY STORES TO JEWELERS, RETAILERS ARE TOUTING THEIR OWN BRANDS AND COMPETING WITH NATIONAL NAMES

Published: April 30, 2000

Section: BUSINESS, page D1

Source: JENNIFER GOLDBLATT, STAFF WRITER

© 2000- Landmark Communications Inc.

A look inside Angela Castillo's shopping cart, as she took her maiden voyage down the aisles of Ghent's new Harris Teeter a few weeks ago, might lead one to believe that her next stop was a television commercial for the store.

One loaf of Harris Teeter sandwich bread. One box of Harris Teeter sandwich bags.

Four cans of Harris Teeter canned peaches.

One bag of orzo under the store's newest private label – H.T. Traders.

"I try to buy the store brand if it's a standard item. It's usually less expensive," Castillo said.

The same is true for Anne Rowland.

"I tend to buy the same stuff over and over, and I usually buy Richfood," she said. But there are exceptions. When it comes to soup and salad dressing, it's Campbell's and Ken's brands. "It's what I grew up with. It's what my mom always bought. I trust it."

Though house brands have been around for decades, a new private-label push has emerged among Hampton Roads retailers, and not just in the grocery stores.

It's in the glass cases of Fink's Jewelers and David Nygaard fine jewelers. And it's on the racks at Dillard's and Nordstrom.

Store brands, also called private label merchandise, are anything sold under the retailer's name. These goods account for one of every five items sold in U.S. supermarkets, drug chains and mass merchandisers. Private labels are a $43 billion industry, up 5 percent over 1998, according to the Private Label Manufacturers Association, a New York City-based trade group of 3,000 manufacturers.

Though private labels date back to the 19th century – when retail pioneers such as A&P carried nothing but house brands – the trend really took off in the 1970s.

With the nation knee-deep in recession and inflation skyrocketing, retailers, grocers in particular, started offering generic products for customers who put low prices above quality or nutrition.

The generics, best known for the trademark black-and-white labels that told little more than the name of the product, often were put into their own section of a store, away from the national brands.

As the economy improved, retailers had the systems in place to develop this business and make it more lucrative.

Because the grocers didn't have the expenses of national ad campaigns, they could sell the goods for less. Even at the lower costs, however, the private-label goods had a better profit margin, and they acted as advertising for the grocers.

One more challenge remained.

Grocers realized that "unless the quality and image of the product improved, it was going to die a slow death," said Tad Black, vice president of grocery merchandising with Farm Fresh, the Norfolk-based grocer with 36 stores.

The private label manufacturers and suppliers also improved the marketing and packaging of those products. Often, private label products are manufactured by the same companies that make the goods for the national brand companies. Eventually consumers began to think of them as more than just the cheapest version on the shelf.

In 1989, Loblaw, a Toronto-based chain of stores, started shipping its President's Choice premium private label brand to the United States. That move jump-started the premium private label brand business, products that have no comparable national brands or are head-and-shoulders above other store brands.

Now, with the convergence of retail channels – the prevalence of grocery items in drugstores and discount department stores, for example – retailers have a chance to build store brand names as powerful as Nike, Tide and Disney.

"Branding is the magic word in everybody's lexicon these days, but it's a very hard thing to do and takes a long time," cautions Paul Kelly a branding consultant in Chicago. "There's so much noise in the marketing environment that to break through and say 'I've got something new here' is hard. You've got to be very consistent with it. If it's a premium private label, you can't compromise on quality, and there's always that temptation.

"A recession helps the private label business, because a lot of it's economically driven. It's kind of a testament to the power of private label that it's continued to grow" even as the economy has been so good, he said.

In the supermarket industry, private labels make up about 20 percent of annual sales, up from 18.4 percent in 1994. Between 1998 and 1999, private label sales grew 3.2 percent, outpacing sales of national brands, which grew by 2.1 percent.

In January, Harris Teeter introduced H.T. Traders, a premium private label of specialty items such as breadsticks and Kalamata olives, and Alfredo pesto sauce. The Charlotte, N.C.-based chain intends to expand into Tex-Mex foods, and introduce a new line of private label candy products this month. Harris Teeter has 1,356 private label products, which account for 18 to 20 percent of annual sales.

Though Wal-Mart Stores Inc. touts "Brand names at Every Day Low Prices," the chain carries about 1,000 private label products.

"First and foremost, we're a branded retailer, but private label is certainly a business we've seen an excellent customer response to," said John Bisio, a spokesman for the retailing giant based in Bentonville, Ark.

"We don't do private label for private label's sake," he said. But they do use it for products where the national brands don't offer a lower, or "opening," price point.

Wal-Mart's private lines include Great Value groceries, Equate health and beauty products and Sam's American Choice.

Ol' Roy Dog Food, named after founder Sam Walton's Springer spaniel, is the best-selling dog food brand in America, Bisio said.

Farm Fresh switched most of its private label brands toRichfood from Farm Fresh, when the Richmond-based wholesaler bought the grocer in 1998. However, Farm Fresh brand milk and other commodity items are still available.

Soon, Farm Fresh stores will add Home Best brands, the private label health and beauty care product line of SuperValu, which acquired Richfood last year.

Private label sales constitute 15 percent of Farm Fresh's annual sales.

Even in departments such as meat, deli, bakery and produce, which aren't dominated by national brands, Farm Fresh is using branding to distinguish itself.

The grocer carries Boar's Head meats exclusively, and its fresh bread program is sponsored by Pillsbury. Farm Fresh also promotes Dole pineapples, Tysons Chicken, Certified Angus Beef and other national brands in those departments.

Beyond the grocery aisles, some local retailers have introduced house brands as a way of setting themselves apart from competitors.

Marc Fink, president of Fink Jewelers, a Roanoke-based retailer with nine locations including one in MacArthur Center, trademarked his Quality Cut and Superior Cut diamonds, in 1993.

"You need to separate yourself from the pack," Fink said.

Fink says that sales of those diamonds make up a large percentage of total diamond sales, and estimates that he has sold more than $100 million of trademarked diamonds.

Two years ago, Virginia Beach-based jeweler David Nygaard started branding watches and carrying them alongside Rolex, Chopard, Vacheron and other big names. More recently, he created three premium-cut private-label diamond brands, Star Fire, Hearts Amore and Ageless Fire.

Each jeweler has agreements with suppliers to cut diamonds to certain specifications, and only those diamonds will bear the trademarked name.

"It's a natural extension of the way consumers buy," said Caroline Stanley, director of marketing and communications with the Jewelers of America Inc., a trade group based in New York. "The names Mikimoto, Rolex easily connote a value when you purchase it. It seems that just now that it's being picked up at a jewelry level everywhere else."

Nygaard stresses that his brand represents not just the name on the diamond. It's the live jazz music he brings into the store on weekends. It's the fresh lemonade and coffee he provides for customers.

At Nordstrom, house brands are a hallmark. They make up 20 percent of annual sales for the Seattle-based department store chain, with men's dress shirts being the hottest house brands.

The company has cut the number of private label brands to better position five brands that are exclusive to Nordstrom, including Classiques Entier, Halogen, Preview, Faconnable, Talora and Calloway Golf clothing.

Last month, Dillard's introduced a new line of menswear designed by Daniel Cremieux. This is an exclusive agreement between Dillard's and the designer, and Dillard's is banking on $70 million in sales from the collection this year.

The Cremieux line joins the host of private labels in Dillard's departments. Preston & York, Roundtree & Yorke, Copper Key and others account for about 20 percent of sales.

"We're trying to fill a need," said Julie Bull, a Dillard's spokeswoman. "First, we want to be a place where customers can get quality brands. If we can't fill their needs with our branded vendor options, then we're going to come in with private label."

Share

Tweet

Share

Mail

By David Nygaard

•

September 13, 2024

Embrace the season with David Nygaard's Autumn Collection. Discover exquisite, autumn-inspired custom jewelry designs with warm tones, leaf motifs, and cozy fashion pairings in Virginia Beach. Find the perfect engagement rings, lab-grown diamonds, and handcrafted wedding bands. Visit the best jewelry store near you for your fall fashion fix!

By David Nygaard

•

June 14, 2024

Celebrate Dad with Timeless Jewelry Father's Day is around the corner, It's a time to celebrate the incredible men in our lives, the ones who offer unwavering support, endless dad jokes (sometimes groan-worthy, but always loved!), and a guiding hand throughout our lives. Dads come in all shapes and sizes, with unique personalities and styles. But one thing remains constant: they all deserve to feel cherished on their special day.

By David Nygaard

•

May 24, 2024

Step into David Nygaard Fine Jewelers this May and explore exclusive jewelry collections in Virginia Beach, Virginia. From custom design engagement rings to unique pieces, unveil your style with our expert custom jewelers. Find the perfect expression of elegance near you.

By 13News Now

•

June 14, 2019

By Eileen McClelland

•

June 14, 2019

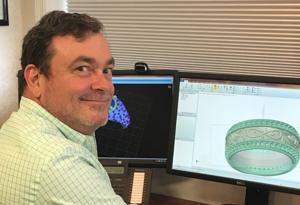

David Nygaard’s 2018 win of a Virginia Beach City Council seat represented the closest race ever in the city’s history. He won by 163 votes, a margin so slim it triggered a recount. It also represented a new direction after Nygaard had a heart attack two years ago. “I coded in the ambulance and decided, after a time of reflection, that I wanted to have a greater purpose, and I’ve always been passionate about issues and politics,” he says. “I want to spend the last years of my life on social justice.” He had hoped to run for a U.S. Congress seat, but when he didn’t qualify for the primary ballot, he shifted his focus to city council, running as a Democrat, another change. The final straw for his conversion from Republican to Democrat came with President Donald Trump’s tax bill, which Nygaard says hurt small businesses and people who were already struggling economically. He also sought to live a more authentic personal life, and so he publicly came out as gay. It’s just the latest chapter in the life of a jeweler that has taken a roller-coaster route in the past decade. In 2008, Nygaard had already been a public figure in Virginia Beach, running a high profile multi-million dollar business. So when the bank seized his home and his seven jewelry stores, along with his inventory, it was big news in the community. He also went through a difficult divorce at the time. But because he was well regarded, his fall from grace wasn’t as debilitating as it might have been. “Because we did a lot of charitable work in the community, a lot of people supported us,” he recalls. “The local media for the most part was supportive and helpful. And most customers were, too.” “You have to be upfront and own whatever problems you bring to the table,” Nygaard says. “One of the first things we did was work to protect the interests of our clients.” He refused to turn over any inventory belonging to his clients, if it had been paid for or if it was in his possession for repair. “We stood firm when they demanded customers’ items.” He brought those items to the one store he was able to reopen and gave refunds to anyone who was unhappy. “Things we were able to deliver, we delivered,” he says. “We took care of our responsibility and they supported us.” The next thing he did was devise a new business model. “When the inventory was seized, all I had was two software keys of Matrix and some old brass and glass samples, and I used those two pieces to create a new business model. I rebuilt a supply chain, and in some cases, we were able to work on the relationships with the same suppliers to do business again.” Nygaard, who has an MBA and is also a certified gemologist appraiser, rebuilt his local reputation with one custom job after another and specialized in engagement rings, using 3D printing and CAD modeling.

June 6, 2019

from Modern Jeweler For the high-end independent, opening more doors may be the key to greater profitability. Posted: April 8th, 2009 09:39 AM GMT-05:00 Consolidation. It’s the byword of the 21st century jewelry industry. A drive down certain American highways, however, unveils a different picture. It’s of that trusted downtown jeweler, the mom-and-pop whose market share seemed so threatened as the 20th century came to a close. The billboards and radio ads tell you he’s now in the adjacent town as well. He’s 20 miles up the road, too, or 300 miles down, and across the state line. And he hasn’t just expanded. As you enter the new locations, you’ll see much the same look, brands, and in-store experience that brought you to his original door. And crucially, in the back office you’ll learn his business is defined by that same feeling of community that kept you a customer when Zales came to town. Have a kid in Little League? The new store’s manager may well be his coach. A favorite Friday night restaurant? He may have a cross-promotion going, or offer concierge service. A defining local event, business group, or charity? A treasured summer retreat or alma mater? He may be a sponsor, be on the board, be your neighbor, and if he’s not your fellow alum, he may be taking on students as summer interns. The four multi-door retailers interviewed for this story had different goals, needs, and methods. All agree that the trick to expanding—a mixture of science, intuition, and friendly bankers—is maintaining the flagship’s premise. Think of it as globalism in miniature. The real action takes place in the backyard. Yours must be the store in its niche, no matter what (or where) that niche may be. In the words of Craig Rottenberg, whose family is currently looking at a seventh door for Boston-area Long’s Jewelers, “We’ve evolved into a destination.” For a jeweler, that means branding, the ones you carry and/or the store itself. “I’m a believer,” says Virginia Beach’s David Nygaard, who has grown from four to 40 employees in three years of expansion, “that brands, like politics, all start local.” MOVING ON UP Long’s, in Massachusetts and New Hampshire. David Nygaard, one Virginia Beach door to six in the Hampton Roads market, and currently looking across the state line to North Carolina’s Chowan River area, where Nygaard has a summer property. Bernie Robbins Fine Jewelry, soon to be ten doors in the New Jersey and Philadelphia area. Ware Jewelers, Auburn, Alabama, grown from a college town staple begun by his father on a $5,000 loan 50 years ago, to four doors in the state. They’re hardly the first retailers who’ve tried to expand. “The early eighties saw a lot of attempts,” remembers Fantasy Diamond president Louis Price, “and a lot of failures.” Over-expansion led to financial failures, errors of management or sustaining a correct price point and merchandise balance, and to loss of personal customer service. By the decade’s end, the big chains were very big, and had begun to swallow local markets. “The guys who are succeeding now,” says Price, “are more cautious. They know how to leverage their strengths—the quality of their people and the intimacy they can offer. They also tend to be going upscale as they expand.” For expanders, upscale begins with location: the lifestyle center of the best local mall, revived downtown areas, free-standing doors. “We’re opportunity driven,” says Bernie Robbins’ Harvey Rovinsky, explaining the decision process for his 10th door, in affluent Short Hills, New Jersey—Robbins’ first with exposure to a customer base commuting to New York City rather than Philly or to the Jersey business corridors. “We know who we are: 30-plus customers at the upper financial reaches. That makes location a bit of a science, not reducible to demographics, but certainly benefiting from them.” The Rottenbergs look at numbers, but rely on gut feeling, and a local road map, as much if not more. “We look at population and income, of course, but convenience is big. How many left turns do you have to make, for example. What’s the exposure to highways or traffic arteries?” The decision-making begins with a single imperative: find a new community. Now in two states, Long’s would have no qualms in expanding to Connecticut or Maine. In the Hampton Roads, Virginia area, where demographics vary widely, location begins, says Nygaard, “with an identifiable pool of jewelry purchasers. But that’s not as easy as it sounds. By census data, we’re low salary. But throw in unearned income—retirees transplanting to Williamsburg—and it goes up quickly.” With each expansion, the business model, and final decision, is therefore shaped not with target numbers, brand awareness, or price point, but with market share as the matrix. “Wal-Mart is number one in the country, with a 6.2 market share. Anything above 6.5 for a given door’s locale is great, and we’ve calculated we hit it in ’05 in Virginia Beach,” the largest of Hampton Roads’ seven cities, with a population of 405,000. “Do not,” says Craig Rottenberg, “expect immediate results. Manage the business, but also expectations. Think of it as sending a kid to college, or opening a new restaurant. The ROI’s not going to be there overnight.” As Rovinsky puts it, “This business inhales cash. With 10 doors, it’s always a challenge to be able to reinvest.” GOOD NEIGHBORS Risk and cost can be defrayed by relocating rather than expanding. Long’s didn’t lose a client in two moves from mall locations to single doors across the street. Six months prior, customers were given shopping bags with the new doors’ likenesses and locales. “It’s funny,” says Rottenberg, “but we had new customers in each location who weren’t aware we’d been across the street in the mall for years.” Long’s saw 25 percent price point growth a year after the moves in Peabody, and Burlington, Massachusetts. “Nordstrom is now moving into the market across the street, validating the attractiveness of each market.” Nygaard’s expansion began in 1999 with a relocation of his mother’s former jewelry store to a free-standing door in a high-traffic center. He feels the distinction is neither affordable nor important in expanding. “Varying with the available space, local feel, the traffic flow, free-standing or in a strip mall. A more important question is who are your fellow tenants?” “All our stores,” says Ronnie Ware, “are across from the Williams-Sonoma, the Chicos, Dillards. Or if not, they’ll come. The developer of our Montgomery door put in 36 holes of golf, then homes and shopping. That store kicked in from go.” Luxury is a condition of the leases Ware signs. “Exclusively high-end lifestyle tenants, guaranteed,” he says. “They require us not to be a credit jeweler. In Spanish Fort [Ware's most distant location, 220 miles from Auburn in a tourist destination], the developer invited us after seeing our Montgomery door, and even stipulated that if we’re not doing $2 million by our fifth year we’re able to get out of the lease. Our first year was over $1 million and we’re 90 percent up already this year.” Space is equally crucial for expanders looking to maintain decor, layout, and shape. Nygaard’s doors tend to be wider than long—a function of general mall shape, but consonant with his thematic look. Interiors keep design consistent from carpet to woodwork to wallpaper to chandeliers. A visitor to any two doors will know they’re in David Nygaard. Two Ware’s doors are identical (“a substantial savings in architectural overhead,” he says) and the three expansions each have a domed ceiling. Four of Robbins’ five biggest doors are all but identical, a streamlining that began with a move of the crucial Philly main line door from Ardmore to Radnor, and continuing with expansions in the Jersey towns of Marlton, Somers Point, and Short Hills. “We spend a lot of money to maintain a uniform luxury experience,” he says. “All our floors have a seating area, a children’s area, a cappuccino area. In Short Hills, we’re establishing a customer vault, where you can store your jewelry, which we’ll clean when you take it out.” For the Rottenbergs, shape is less crucial than size, with doors tending less to the 2,500-foot than 8,000-square-foot plan, though the burgeoning mini-chain has both. Big believers in in-store events, Long’s has had Mini-Coopers and motorcycles in its doors. “Big or small,” he says, “the look and feel is consistent. We’re classy without being stuffy. For us, that translates into open space. No in-store boutiques, though brands are welcome to put in their fixtures. But the sightlines have to be open.” A STORE TO RUN Do you carry branded jewelry? Are bridal diamonds loose or set? What price points can you achieve? Are you a micro-manager or a delegator? A consignment buyer, a memo man, or a believer in owning your merchandise? What do you look for when you hire? Are you year-round or seasonal? What comes first, ads or marketing? And just how close are you to your banker? Auburn’s Ronnie Ware had never owed a cent in his life until he expanded. Rent on the flagship, a downtown fixture, had been locked in at $350 per month half a century earlier. When two strip-mall expansions ran into trouble, he was able to raise over $1 million on close-outs. “We started at 30 percent off, and were down to 70 percent by the end,” says Ware, whose easygoing manner belies the enormous amount of work and risk involved in expanding. “We just kept going as long as it wasn’t cheaper to smelt.” The Rottenbergs bought 128-year-old Long’s as a multi-store affair. They scaled back on doors initially, then began its complex series of relocations, consolidations, and expansions a decade later. “Expansion,” Rottenberg says, “would be impossible without support from vendors and lenders.” Nygaard and Rovinsky have very close relationships with their bankers. Nygaard’s is a customer, a friend, and advisor on business plans. Rovinsky has taken his to Vegas for JCK. “I share financial information with him in the most timely and proactive manner you could imagine.” “For us,” says Ware, “it was our cash strength rather than a business plan that sold us to the banker. It helped us lock in a great rate on five year notes for two of the stores, and eased the line of credit we decided to go with in Montgomery.” That cash strength, coupled with the lessons learned in closing out the two strip-mall locations, led to changes in Ware’s buying, branding, and stock balancing policies. “Some of that merchandise was two or three years old. We’re largely a consignment buyer now. I won’t even take an appointment unless it’s long-term memo.” It’s a strategy enabled by the diamond category. “We’re not a preacher of cut,” says Ware, “though we do stress color. We’re G SI1, average sale. Everything is loose, and we offer a full range of mountings, and a jeweler in each door.” And for branded lines? Ware carries Hearts On Fire but only in two of four doors. “If you’re not doing national advertising, we have forms and policies for how long we’ll carry on consignment. Some vendors have balked, but most folks I’ve bought from in Vegas for years stayed with us, particularly once they see that our stock balancing, which we do for ourselves now, is consistent with their goals.” “I’m not a big believer in branded jewelry,” says Nygaard, who carries Simon G. and Hearts On Fire—brands he feels enhance his store identity. “You can very justifiably choose to go that way, but I don’t want to see the tail wagging the dog in my stores, or see my associates as clerks writing down the next order. I want to see them selling fine jewelry. For right or wrong, we chose to lead with our identity, the David Nygaard name.” The strategy is consistent with Nygaard’s role in his communities. He’s prominent in everything from the baseball league to the local children’s hospital to regional CEO groups and mentoring programs. It extends to his marketing and advertising strategies—intensely civic-minded, and geared to the community. Diamonds accompanying the birthday cake in restaurants. Planners advising presentation of the engagement ring. Store bags with gift certificates. Dinner at Ruth Chris, gratis with every major purchase. Nygaard has great regard for Audi’s “Key People” strategy, in which dealers provide cars to highly visible locals, and he emulates it in various ways. All of it has grown organically from Nygaard’s initial motivation in expanding. “The first years of the decade saw jewelers losing market share,” he says. “I realized I could survive but not thrive in my current course. From the first change to the last, my goal has been single-minded: Find a platform for a branded in-store experience.” That’s manifest when you enter a Nygaard door, from the tea service to private label diamonds. It’s clearer still in the type of personal service. Nygaard raided mall stores for associates in early expansions, banking on experience. “Some worked out, some didn’t. I created a profile of those that did, and use DISC [a business personality test] to establish two crucial criteria for successful candidates: influential and mature. Of the efficiencies that come with expansion, perhaps the greatest savings for us is in shortening the time to truly season an associate.” He encourages spontaneity above all in sales. “It’s hard to make a mistake if you’re providing a luxury experience.” OFFICE SPACE The four have markedly different sales training, compensation methods, and policies. Long’s, which relies heavily on research for its associate profile, has never paid commission. Rovinsky, who has a Wharton MBA in-house part-time to run sales training, has found that a continually evolving formula for compensation has been the ticket. All four stress that ownership of individual doors is crucial to a manager’s success. “It has to be their door ultimately,” says Nygaard. Rebecca Garnick, Long’s marketing director, puts it aptly. “Think of the doors as children, each with their own personality and path to maturity.” Ware is even more succinct and hands-off. “One of the new associates in our Montgomery door was shocked to learn there was a Mr. Ware.” All hold manager’s meetings on a monthly or weekly basis, and bring associates to shows. After opening his fourth door, Ware hired an auditorium at Auburn to hold a sales training seminar. Expansion brought a change in advertising philosophy, the obvious difference being in print and television versus billboards—a more sensible and affordable vehicle for a multi-door retailer operating along often interlocking traffic arteries. Long’s finds it can reach all its markets with a single ad in Boston Common, and sees efficiency in billboards, TV, and radio. Ware decided to abandon radio with the exception of the local sport radio call-in show. “I get so much more bang for the buck on the highways, where I have dozens going at any one time.” The trend has been more toward marketing and public relations. Both Long’s and Robbins created in-house marketing divisions, and invest in cause or charity marketing, or event driven strategies. “There’s no easy way to quantify the results,” says Rottenberg, “but we have long been prominent sponsors of the Boston Marathon. It’s such an important event, and our participation reaches well past the local doors.” Rovinsky’s most recent coup came when Rolex brought students to his Radnor door to witness marketing in action. A second will come when Atlantic City’s minor league baseball team renames its ballpark Bernie Robbins Stadium. As growth created new marketing and corporate responsibilities for Nygaard’s more conventional budget, he simply amended his managers’ job descriptions. One does human resources, others oversee training, recruiting, and merchandising. “I feel it enables me to offer them a career path, rather than a management or sales job. That is part of the puzzle for creating the branded in-store experience, for it truly is a platform, the base on which everything is built.” It’s a philosophy and strategy shared by Long’s and Robbins, though both are brand believers, for marketing and merchandising. Long’s, with multiple bridal, fashion, and watch lines, regularly hosts in-store events, from David Yurman and Scott Kay to Breitling. Robbins, whose floors are defined by its brands, has regular sales associate training from the likes of Hearts On Fire, as well as galas featuring the work and the personalities of designers like Michael Beaudry, Michael B., and Penny Preville. Most brands are global to all Long’s and Robbins doors, and Rottenberg feels it’s the single greatest efficiency expansion has brought—from pricing to making a large inventory productive across the entire company. “Whether you’re a brand believer or not,” says Rovinsky, “the key to growth, and this really applies to single doors as much as to expansion, is the in-store experience. For us, that means comfort and luxury. Our customers come home to us. And the task, as we’ve grown, has been to achieve a seamless transition of that homecoming.” For Ware, that homecoming can seem as seamless as watching television. “I have eight cameras in each of the stores, and I watch live feed from them all the time,” he says. In the large brick downtown building, business is good. An associate is calling from the sales floor about a 5.1 carat radiant. Ware, who bought the building when the 40-year lease his father signed expired, will be tearing the old flagship down in the next two or three years. “It’s kind of a white elephant. Time for a new look.” And that look? “Not entirely sure,” he says. “But I wouldn’t be surprised if it doesn’t look a whole lot like the Montgomery and Spanish Fort doors.” original story in ModernJeweler